A trend is a clear direction in the market, consisting of the formation of higher highs and higher lows(Bullish) or lower highs and lower lows(Bearish). On top of that, for clarity, we will also be testing for the definition of a trend. Also, we can take the average number of times a false breakout occurs before the complete change in trend as further evidence to support the responsiveness of 200 EMA as a support and resistance. To measure this, we will simply take the average number of exact rejections (no false breakouts) in a trend to determine if the 200 EMA aligns with the support and resistance zone in the market.

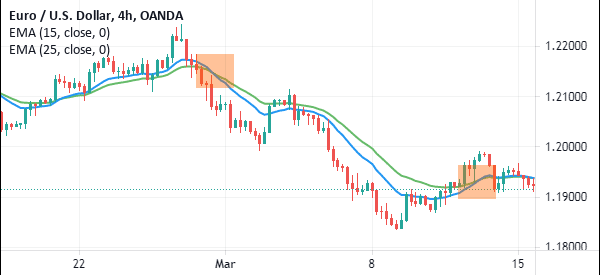

The major factor to take into consideration will be the responsiveness of the support and resistance. To evaluate the reliability and strength of the 200 EMA, we must first define what makes a good dynamic support and resistance line. This is of course subjected to the characteristics of the individual pairings it is applied to and the settings on the EMA itself. However, it may still be prone to fake outs at times, especially when the support and resistance is a zone concept and thus a single line may not be 100% accurate at representing it, therefore using it alone as a gauge of support and resistance might lead to observed fake outs due to subjectivity. To top that off, it is flexible with customisable settings to suit unique trading strategies. The EMA as mentioned is a good dynamic support and resistance line which also identifies the trends of the market relatively well especially in the long term. With that, the most common period setting, 200, will be used here as a sample.Īlso read: Simple Moving Average Trading Strategy Thus, the main objective of this article will be targeted to uncover exactly how strong and reliable the EMA is in terms of dynamic support and resistance.

Though they are quite similar, the main difference is that EMA is deemed by many to be a stronger dynamic support and resistance line. Both methods of using the moving average have been explored in the SMA article. Also, it can be used to identify bullish and bearish trends. Like the SMA, it can be used as part of a crossover set up to find entries and exits. Instead of dividing the weightage of the calculation evenly among the candles in the period like the SMA, the EMA is able to provide a smoother and less choppy support and resistance. The calculation is done exponentially where it results in reflecting recent candles in a heavier weightage.

Lastly, the application of the indicator refers to the type of sample data to be used for the calculation.Īs similar as it may seem to its counterpart, the SMA, the EMA’s calculation is very different from the SMA. Thirdly, the method of the indicator refers to the type of calculation involved. Secondly, the shift of the indicator is the change in the candles taken into calculation without changing the period, from the most recent candle. Firstly, the period of the indicator is the number of past candles taken into calculation. Similar to the Simple Moving Average(SMA), users are able to tweak the parameters of the indicator, which contains the period, shift, method and application. An exponentially weighted moving average reacts more significantly to recent price changes than a simple moving average (SMA), which applies an equal weight to all observations in the period. The exponential moving average is also referred to as the exponentially weighted moving average. An exponential moving average (EMA) is a type of moving average (MA) that places a greater weight and significance on the most recent data points.

0 kommentar(er)

0 kommentar(er)